You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-3: Indian Economy and issues relating to planning, mobilisation of resources, and growth.

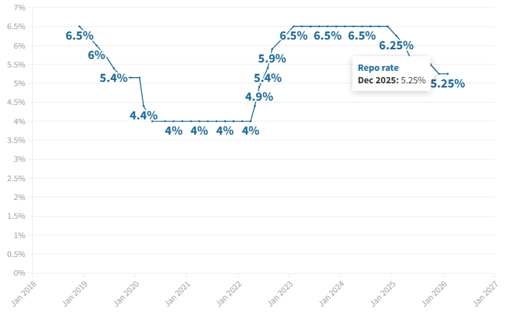

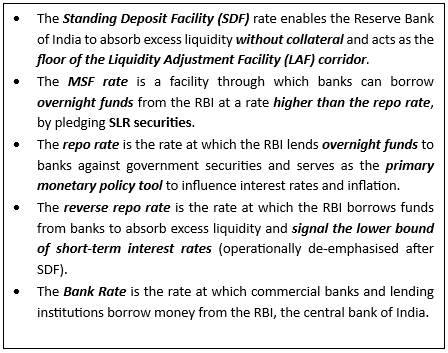

Context: Reserve Bank of India (RBI) announced that the Monetary Policy Committee (MPC) has unanimously decided to keep the policy repo rate unchanged at 5.25%, while maintaining a neutral policy stance.

More in the News

Policy Rates & Stance:

• The Standing Deposit Facility (SDF) rate remains at 5%, while the Marginal Standing Facility (MSF) rate and the Bank Rate continue at 5.5%, keeping the liquidity corridor unchanged.

• The RBI reiterated that future monetary policy actions will be guided by incoming macroeconomic data, including inflation data based on the revised CPI series, and the evolving growth outlook.

Inflation Outlook:

• CPI-based retail inflation for FY26 is projected at 2.1%, within the RBI’s tolerance band of 2–6%.

• Inflation is expected to rise gradually due to unfavourable base effects, with projections of:

• Provisional data shows headline CPI inflation at 1.33% in December 2025, providing comfort to policymakers amid global uncertainties.

Growth Projections:

• The RBI revised upward its GDP growth outlook, reflecting resilience in domestic demand:

• Full-year FY27 growth projections will be released after the new GDP series is notified.

Liquidity & External Sector:

• System liquidity averaged around ₹75,000 crore on a daily basis, with the RBI remaining proactive in liquidity management.

• Forex reserves stood at a comfortable $723.8 billion by end-January, strengthening external stability.

Regulatory & Developmental Measures:

• RBI proposed compensation of up to ₹25,000 to customers for losses from small-value fraudulent digital transactions.

• Draft guidelines to be issued on:

• To support credit flow and ease of doing business:

About the Monetary Policy Committee (MPC)

• It was established in September 2016, under Section 45ZB (1) of the Reserve Bank of India Act, 1934 (RBI Act).

• The Urijit Patel Committee had recommended the setting up of the MPC

• The MPC’s primary role is to set the Policy Rate required to achieve the inflation target.

• According to Section 42B (2) of the RBI Act, the MPC consists of:

• Members appointed by the Central Government hold their positions for a term of four years or until further orders, whichever is earlier.

• According to Section 45ZA of the RBI Act, the inflation target is set at 4%, with an upper tolerance level of 6% and a lower tolerance level of 2%.

Source:

DD News

Shriram Finance

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details